Ohio Sales Tax On Cars Purchased Out Of State

There are basically two ways the tax can work out on an out-of-state sale. She received 5040 for her trade-in.

Ohio License Plate Lookup Free History Report

However you may need to.

Ohio sales tax on cars purchased out of state. Examples of activities that create nexus are. Depending on the rules of your state an out-of-state vehicle may need vehicle identification number VIN verification. The sales tax rate to apply to the Ohio price is 60.

Sales that are exempt from the retail sales tax are also exempt from the motor vehicle saleslease tax. The purchaser will be taking her new car to Ohio. However if you purchase your out-of-state vehicle in California and plan to drive the car from the dealership you must pay Californias sales tax.

Oregons DMV for example charges 7 while the Kansas Highway Patrol commands. Sellers should collect the use tax on sales they make to Ohio residents. The cost varies by state and inspection unit.

This provision does not affect the application of sales tax to motor vehicle purchases by Ohio residents. Or in some instances at your local DMV office. Sellers who have nexus with Ohio are legally required to register collect and remit use tax in the same way that the Ohio-based vendor collects and remits sales tax.

Sometimes dealerships handle this process for you and pass along the sales tax to your home state. However some states such as Alaska New Hampshire and Delaware dont charge sales tax on car purchases in general while Oregon charges. Even though youre buying a car from out of state youll pay the sales tax to the state in which youll register the carie.

Ohio Sales Tax On Cars Purchased Out Of State. Sales tax is charged every time a vehicle is bought or sold regardless of sales tax paid by a previous buyer. You need to pay taxes.

There are also county taxes that can be as high as 2. According to Carfax you should pay sales tax to the state where you will register your vehicle where you live not to the state where you bought the vehicle. If you purchase merchandise from those sellers the obligation rests with the consumer to pay the use tax which is equivalent to paying sales tax.

You pay the sales tax when you register your vehicle in your home state with your local department of motor vehicles DMV. Selling a car can be done through a couple of different routes. If an out-of-state seller has sufficient contact with the state nexus the seller is required to abide by Ohios tax laws.

5739029 applies to all sales of motor vehicles by an Ohio motor vehicle dealer to a Nonresident who removes the vehicle from Ohio to be titled registered or used outside Ohio whether in another state or in a foreign nation. Keep a copy of the report of sale. Still you should always keep records that you paid the sales tax to show your states title and registration office.

If you are selling your vehicle to a car dealer just as in purchasing from one all of the taxes and title fees will be taken care of by the dealer. The purchase price is 10760. Calculate the price in the applicable state taking into account the adjustments in the chart below such as a trade-in allowance if permitted by the state and apply the sales tax rate of the appropriate state listed in the chart below.

You dont pay. Its best to ask the dmv representative. If the out-of-state tax amount is the lower amount show in the Remarks section on the RD-108 the method used to determine the sales tax such as five percent Ohio tax with 5040 trade-in credit.

If you are selling to another individual then you would agree to a purchase price and transfer. Ohio sales tax on cars purchased out of state. Depending on your state this may include sales tax use tax andor wheel tax.

Some dealerships may also charge a 199 dollar documentary service fee. Your states sales tax depends on the state in which you live not the state in which you buy the car. Use tax is a tax on items used in washington when sales tax hasnt been paid.

This page covers the most important aspects of ohios sales tax with respects to vehicle purchases. Selling A Car In Washington State Sales Tax - Ohio Sales Tax On Cars Purchased Out Of State. In the united states each state has its own laws and rules regarding sales tax on vehicles.

For more information about state sales taxes when it comes to purchasing a vehicle from out of state click here. Vehicle sales tax rates often range between 15 percent and 8 percent and may have a minimum charge. In addition to taxes car purchases in Ohio may be subject to other fees like registration title and plate fees.

You should have the out-of-state title and a bill of sale. If you buy your used car from a private party in another state your home state will collect sales tax when you go to register the car. The first option is the dealer can charge you sales tax and tags based on your location and sell you the car with temp.

You can usually have this done for a small cost at a local law enforcement agency. It can be tempting to try to buy. Is Buying A Car Tax Deductible 2020 - Follow the links at the end sales tax is a percentage of the purchase price of the car as reported on the bill of sale.

Please note that the sales tax rates listed in the chart. According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

What S The Car Sales Tax In Each State Find The Best Car Price

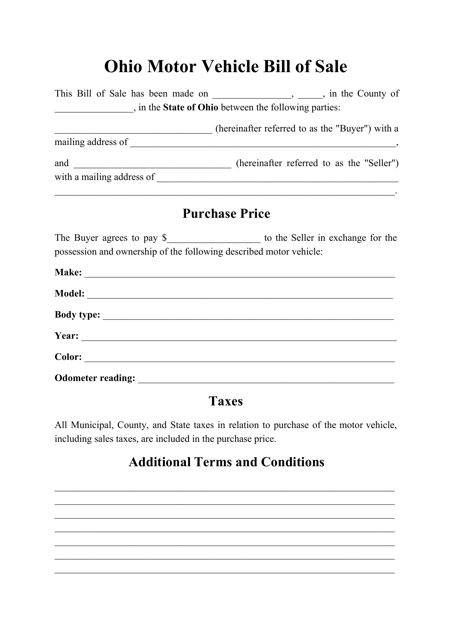

Free Ohio Bill Of Sale Forms Pdf

Buying And Selling A Vehicle Department Of Taxation

Virginia Sales Tax On Cars Everything You Need To Know

Vintage 1967 Plymouth 2dr Satellite Auto Title Only Historical Document From Ohio 1976 Car Title Historical Documents Title

Medina Cadillac Ohio S Premier Cadillac Dealer

Ohio Motor Vehicle Bill Of Sale Download Printable Pdf Templateroller

How To Gift A Car A Step By Step Guide To Making This Big Purchase

All About Bills Of Sale In Ohio Forms Templates Facts Etc

Overview 1907 Electric Cars Page 15 Electric Cars Electricity City Vehicles

Pin On Auto Titles Historical Documents For Sale

20 California Resale Certificate Template Dannybarrantes Template Preschool Newsletter Templates Certificate Templates Problem Statement

How To Buy A Car In Another State Tom Gill Chevrolet

Ohio S New Car Sales Tax Calculator Quick Guide

Ohio Sales Tax Small Business Guide Truic

2021 Skoda Octavia Rs Spied Earlier Than And After Accident Skoda Superb Skoda Octavia Skoda

Sales Tax On Cars And Vehicles In Ohio

Vintage 1963 Chevrolet Conv Auto Title Only Historical Document From Ohio Car Title Historical Documents Chevrolet

Post a Comment for "Ohio Sales Tax On Cars Purchased Out Of State"